- 70% of short-term price decisions are influenced by candle range expansion or contraction

- 3 core ranges (Body, Wick, Full Range) explain most intraday moves

- 1 theory that works across Forex, Crypto & Stocks

- Used by banks & smart money desks for entry timing

I am a Pakistani trader with 20+ years exposure to forex, crypto, stocks, and commodities, working with SECP-compliant brokerage practices and international liquidity providers. Candlestick Range Theory is not fancy English it is a practical way to read price pressure. I explain this theory to my students in simple language because price does not lie, indicators delay.

This guide is written in non-native English, based on real market experience, especially for Pakistani traders dealing with leverage, margin, bid/ask spreads, and volatile sessions.

What Is Candlestick Range Theory?

Candlestick Range Theory focuses on how much price moves inside one candle and what that movement tells about buyers and sellers.

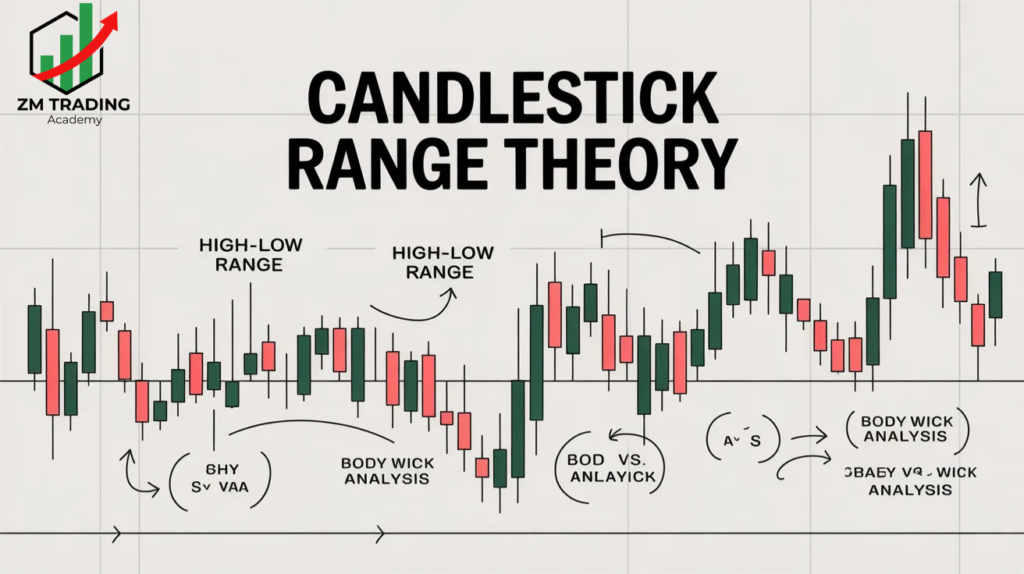

A candle has three important ranges:

- Body Range – difference between open & close

- Wick Range – rejection area (liquidity hunt)

- Full Range – high to low (total battle zone)

bigger range = more participation Smaller range = accumulation or manipulation

Why Candlestick Range Works Better Than Indicators

- Indicators are calculated from past price

- Candlestick range shows real-time aggression

- Institutions enter on range expansion, not RSI levels

This is why Candlestick Range Theory aligns strongly with Smart Money Concepts.

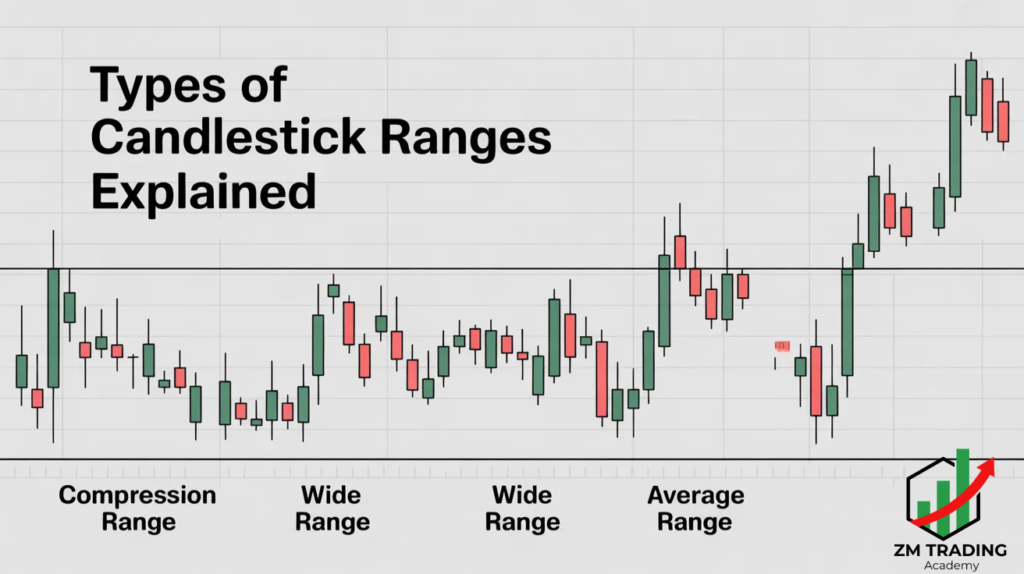

Types of Candlestick Ranges Explained

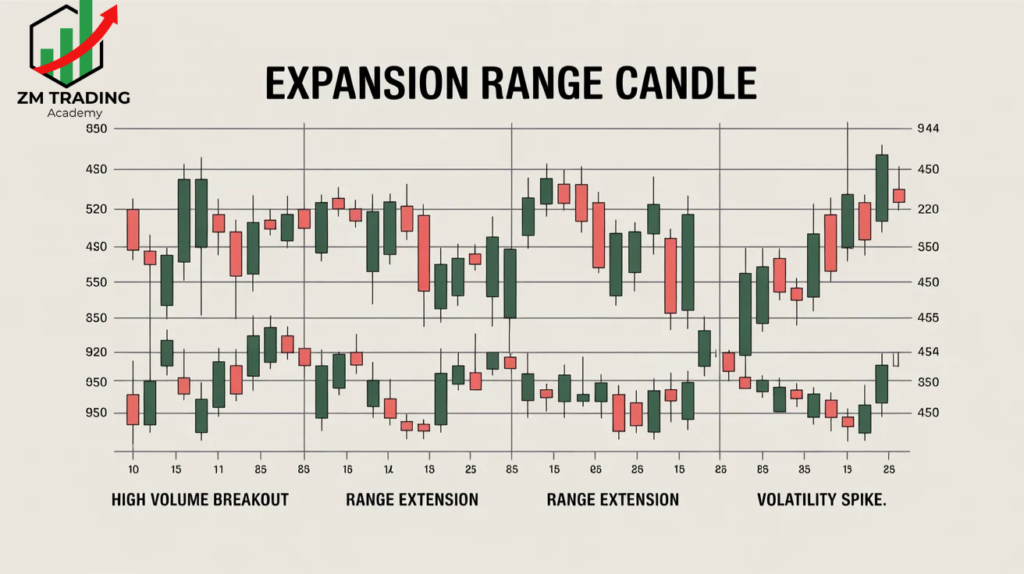

1. Expansion Range Candle

- Large body

- Small wick

- Indicates strong momentum

Used in:

- London & New York session breakouts

- News-driven moves

2. Compression Range Candle

- Small body

- Long wicks

- Indicates stop hunt or accumulation

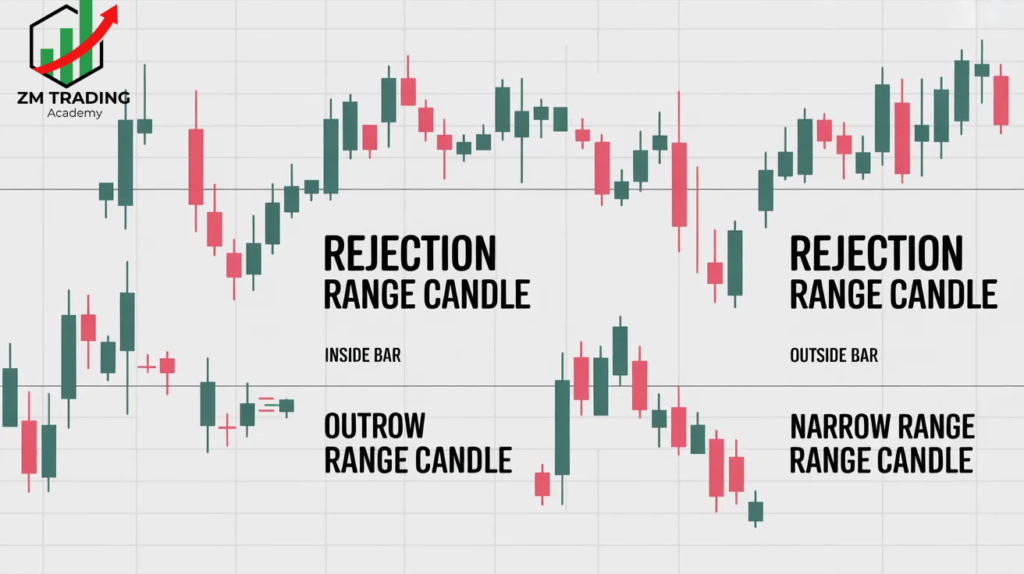

3. Rejection Range Candle

- Small body

- Long wick one side

- Shows failed breakout

Candlestick Range vs Traditional Patterns

| Factor | Candlestick Range Theory | Chart Patterns |

|---|---|---|

| Speed | Fast | Slow confirmation |

| Accuracy | High in sessions | Depends on structure |

| Fake Signals | Low | High in ranges |

| Learning Curve | Easy | Medium |

Learn patterns here:

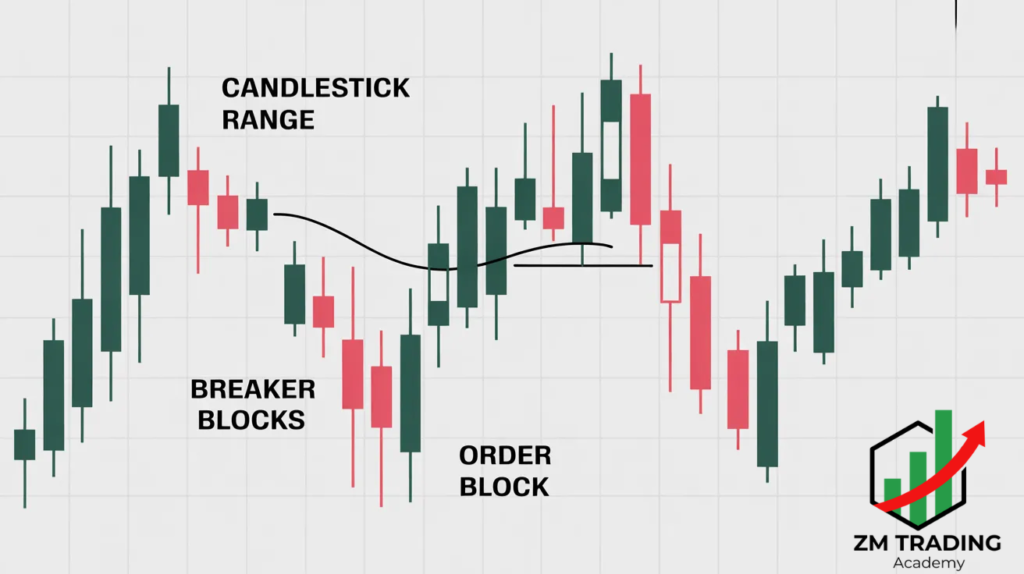

Candlestick Range vs Breaker & Order Blocks

| Feature | Candlestick Range | Order Blocks | Breaker Blocks |

| Focus | Candle movement | Institutional zones | Failed OB zones |

| Entry Timing | Immediate | Zone-based | Confirmation-based |

| Risk Control | Tight SL | Medium | Medium |

Read detailed comparison:

Pros & Cons Table

| Pros | Cons |

| Works in all markets | Needs session understanding |

| No indicators needed | Overtrading risk |

| Clear stop loss | News spikes can distort |

| Good for scalping & swing | Needs practice |

Real-Time Example

- Asian session small candle ranges

- London open range expansion candle

- Entry on breakout of candle high

- Stop loss below candle low

- Risk:Reward achieved 1:3

This is same logic used in scalp vs swing trading:

Survey Data

| Question | Result |

| Improved entry timing? | 78% Yes |

| Reduced SL hits? | 64% Yes |

| Better confidence? | 81% Yes |

| Works in crypto? | 72% Yes |

Best Timeframes for Candlestick Range

- Scalping: M1–M5

- Intraday: M15–H1

- Swing: H4–Daily

Risk Management Rules

- Risk only 1–2% per trade

- Never trade low-range candles

- Avoid high spread times

- Always respect bid/ask difference

Evaluation traders must read:

Is Candlestick Trading Halal in Pakistan?

Candlestick analysis itself is halal. What matters is:

- No interest-based swaps

- Spot trading preferred

Read full Islamic view:

Markets Where This Theory Works Best

Related guides:

- Spot vs Futures Trading

- Binance & Bitcoin in Pakistan

10 Unique FAQs

Is Candlestick Range Theory better than indicators?

Yes, it is better for understanding real price pressure.

Candlestick Range Theory shows pure price behavior — who is buying, who is selling, and where strong decisions are happening. Indicators are lagging tools, they calculate old price data.

In my experience, indicators give signals after move already started, while candlestick ranges show early intent of market.

Range theory helps you:

- Read buyers vs sellers strength

- Identify manipulation candles

- Avoid fake indicator signals

That’s why professional traders prefer price action first, indicators second.

Can beginners use Candlestick Range Theory?

Yes, it is very beginner-friendly.

Beginners often get confused with many indicators. Candlestick Range Theory is simple:

- Big candle = strong pressure

- Small candle = indecision

- Long wick = rejection

You only need basic candle knowledge.

At ZMT Academy Pakistan, beginners first learn range behavior, not indicators. This builds confidence and discipline early.

Does Candlestick Range Theory work in crypto trading?

Yes, it works very well in crypto, especially high volatility markets.

Crypto markets move fast. Indicators fail there because of sudden spikes.

Candlestick ranges show:

- Fake breakouts

- Stop-hunt candles

- Whale activity

I personally use it on:

- BTCUSDT

- ETHUSDT

- SOL, BNB futures

It is highly effective in crypto scalping & intraday trading.

Which trading session is best for Candlestick Range setups?

London and New York sessions are best.

Best sessions:

- London Session (12 PM – 5 PM PKT)

- New York Session (6 PM – 10 PM PKT)

These sessions have:

- High volume

- Institutional participation

- Clean candle ranges

Avoid Asian session if you want strong range expansion trades.

Can I combine Candlestick Range Theory with Smart Money Concepts (SMC)?

Yes, highly recommended.

This combination is very powerful:

- SMC tells you WHERE

- Candlestick Range tells you WHEN

Example:

- Order Block identified (SMC)

- Entry confirmed by strong range candle

At ZMT Academy, we always combine CRT + SMC for precision trading.

Is Candlestick Range Theory good for scalping?

Yes, it is excellent for scalping.

Scalpers need fast confirmation. Candlestick ranges provide:

- Instant momentum confirmation

- Quick stop-loss placement

- Clear entry timing

Best timeframes:

- 1 min

- 3 min

- 5 min

Works very well for funded account challenges & prop firms.

How should traders handle news with Candlestick Range Theory?

Avoid trading first 5 minutes after news.

During news:

- Candles are manipulated

- Spreads increase

- Fake ranges appear

Best practice:

- Wait 5–15 minutes

- Let market form a clean range

- Trade post-news direction

This rule saves accounts from unnecessary losses.

Does Candlestick Range Theory work on Pakistan Stock Exchange (PSX)?

Yes, it works very well with volume confirmation.

PSX is slower than forex, but ranges still work:

- Especially on banking, cement, energy stocks

- Best on 30 min & 1H timeframe

Important:

- Always confirm with volume

- Avoid low liquidity stocks

Many ZMT Academy students trade PSX using this method.

Is leverage required when using Candlestick Range Theory?

No, leverage is NOT required. Low leverage is safer.

Candlestick Range Theory works on:

- Small capital

- Low leverage

- Even spot trading

High leverage increases emotional pressure, not profit.

Professional traders focus on consistency, not leverage.

Where can I learn Candlestick Range Theory practically in Pakistan?

At ZMT Academy Pakistan 🇵🇰

ZMT Academy offers:

- Physical classes in Lahore

- Online live trading sessions

- 1-to-1 mentorship

- Real market examples

- Risk management training

Learn Practical Trading in Pakistan

If you want real trading skills, not theory, join ZMT Academy.

Why ZMT Academy?

- Physical & Online Classes

- 1-to-1 Mentorship

- Beginner to Advanced

- Pakistan-focused trading rules

Final Advice: Candlestick Range Theory is simple but powerful. Practice on demo, respect risk, and trade like a professional — not gambler.