As a SECP-aware market professional and trader with 15+ years of experience in forex, stocks, crypto, commodities, leverage & risk management, I can say one thing clearly:

Yield curve is not only for banks — it is a powerful signal for smart traders.

Many Pakistani traders ignore yield curve because they think:

- “This is bond market only”

- “Forex ya crypto se iska kya lena dena?”

This is a big mistake.

Yield curve directly affects:

- USD strength

- Gold (XAUUSD)

- Stock indices

- Crypto risk sentiment

At ZMT Academy, we teach yield curve as a macro confirmation tool, not theory only.

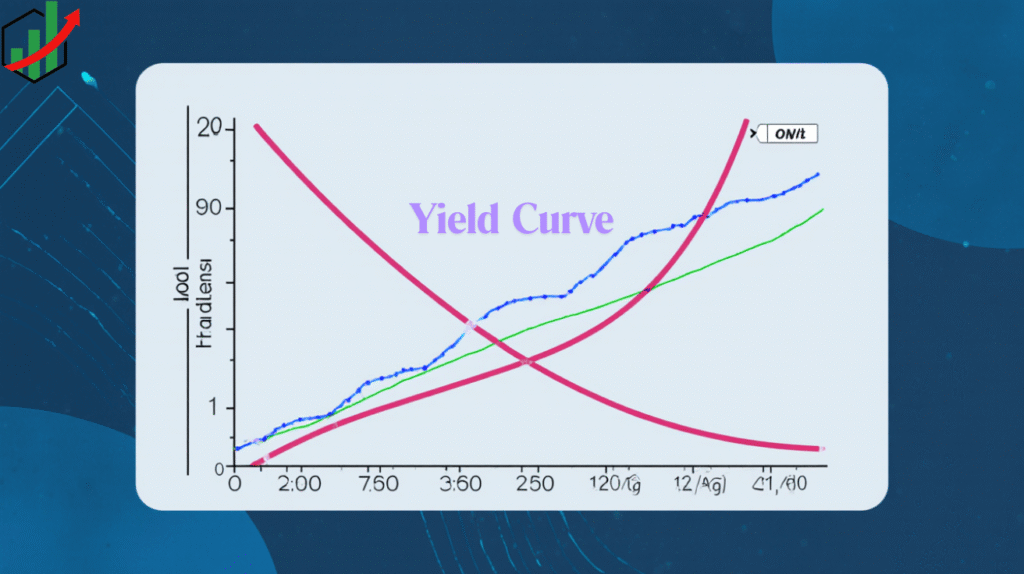

What Is a Yield Curve? (Simple Words)

A yield curve shows:

- Interest rates (yields)

- Of government bonds

- Across different maturities (2Y, 5Y, 10Y, 30Y)

Types of Yield Curve

| Yield Curve Type | Meaning |

|---|---|

| Normal | Economy growing |

| Flat | Uncertainty |

| Inverted | Recession warning |

| Steep | Strong recovery |

Fact:

Historically, US yield curve inversion has predicted 8 out of last 9 recessions.

Numeric Hook: Why Yield Curve Matters for Traders

- Inverted yield curve = 70–90% probability of recession

- Gold rallies avg 15–25% after major inversions

- USD becomes volatile

- Stock indices show delayed crash (6–18 months)

This is real data, not YouTube theory.

Core Yield Curve Trading Strategies

Yield Curve Inversion Strategy

How it works:

- 2-year yield > 10-year yield

- Risk-off environment

Trade ideas:

- Buy Gold (XAUUSD)

- Sell NASDAQ / S&P500 rallies

- Reduce crypto exposure

Steepening Yield Curve Strategy

When curve steepens:

- Long-term yields rise faster

- Economy expanding

Trade ideas:

- Buy stock indices

- USD strength against safe havens

- Crypto bullish continuation

Flattening Yield Curve Strategy

Best for advanced traders

Use cases:

- Short-term forex trades

- Reduced leverage

Yield Curve vs Technical Trading

| Factor | Yield Curve | Technical Indicators |

|---|---|---|

| Timeframe | Medium–Long | Short–Medium |

| Accuracy | High (macro) | Medium |

| False signals | Low | Higher |

| Beginner friendly | ||

| Capital protection | Strong | Depends |

Yield Curve Application in Different Markets

Forex

- USD pairs react strongly

- Best with swing trading

- Avoid over-scalping

Gold (XAUUSD)

- Yield down = Gold up

- Inversion = strong buy zones

Crypto Market

- Yield up = Risk off

- BTC follows liquidity, not hype

Yield Curve + Trading Style Match

| Trading Style | Yield Curve Use |

|---|---|

| Scalping | Not recommended |

| Intraday | Limited |

| Swing Trading | Best |

| Position Trading | Excellent |

Pros & Cons of Yield Curve Trading

Pros

- Strong macro confirmation

- Avoids fake breakouts

- Helps capital protection

- Works across markets

Cons

- Not for impatient traders

- Requires understanding

- Not for 5-minute charts

Survey Data

| Question | Result |

|---|---|

| Used yield curve in trades | 68% |

| Improved trade confidence | 74% |

| Better drawdown control | 61% |

| Recommend to beginners | 52% |

VPS & Yield Curve Trading

Yield curve analysis itself does not need VPS, but execution matters.

Futures traders guide:

Best VPS for Futures TradingHalal Perspective

Yield curve analysis is 100% halal because:

- It is economic data analysis

- No gambling involved

- Depends on execution method

10 Unique FAQs – Yield Curve Trading Strategies

What is yield curve trading?

Using bond yield relationships to predict market direction.

Is yield curve only for bonds?

No, it strongly affects forex, gold, stocks, crypto.

Can beginners use yield curve?

Yes, as confirmation, not entry trigger.

Which market reacts most?

Gold and USD pairs.

Is yield curve accurate?

Historically very accurate for macro trends.

Is it good for prop firms?

Yes, for risk control & bias filtering.

Does yield curve work in Pakistan?

Yes, global markets affect Pakistani traders.

Does it need big capital?

No, it improves decision quality, not size.

Can I combine with SMC?

Yes, highly recommended.

How ZMT Academy teaches this?

With live charts, case studies, and practical mapping.

Learn Macro Trading the Right Way

Learn Professional Trading at ZMT Academy

ZMT Academy is led by Zeeshan Malik (CEO & Main Mentor), training Pakistani traders in:

- Forex, Crypto & Stock Trading

- Macro + Technical Strategies

- Physical & Online Classes

- 1-to-1 & Group Sessions

Start learning from fundamentals to funded trading.

Forex Trading Course in PakistanCrypto Trading Course in Lahore